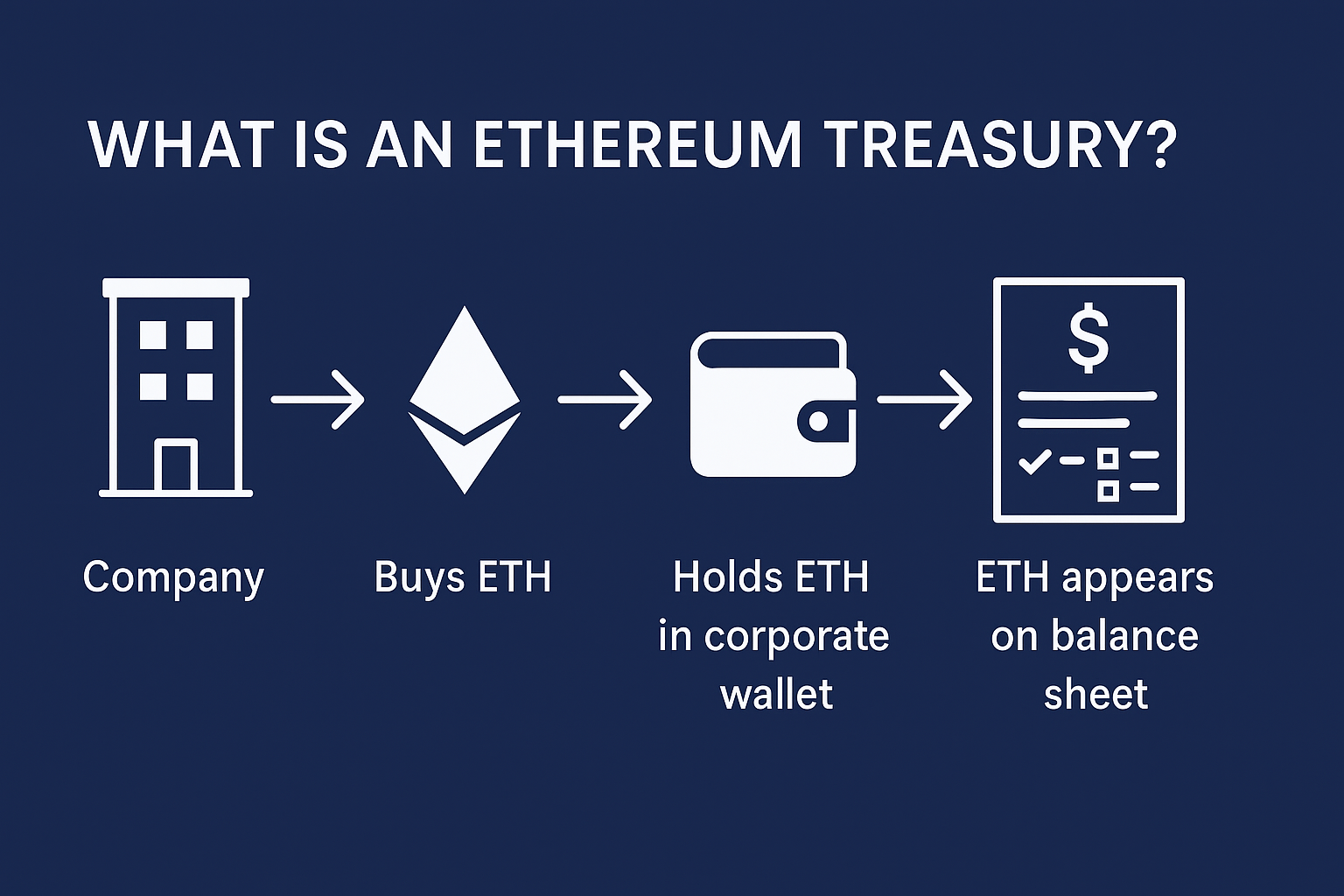

Definition: Ethereum Treasury

An Ethereum treasury refers to the Ethereum (ETH) holdings that are owned and managed by a company, fund, public institution, or even a decentralized autonomous organization (DAO). These holdings are typically disclosed on financial statements and serve a variety of strategic, financial, and technical purposes for the organization.

Why do Companies Hold Ethereum?

- Asset diversification: ETH acts as a hedge or growth asset, diversifying traditional cash or stock holdings.

- Strategic investment: Early exposure to blockchain infrastructure and web3 innovation.

- Participation in staking: Earning yield from the Ethereum network by operating validators.

- Market signaling: Demonstrating technical leadership and a forward-thinking strategy.

- On-chain activity: For companies needing ETH to interact with DeFi, NFT platforms, or for transaction fees.

Public Companies with Ethereum Treasuries

Since 2021, an increasing number of public companies have started adding ETH to their treasuries. This move is similar to the early wave of corporate Bitcoin adoption but with a focus on Ethereum’s utility as both an asset and a programmable blockchain platform.

- BitMine Immersion Technologies (BMNR): One of the largest disclosed ETH holdings by a US-based mining/engineering firm.

- SharpLink Gaming (SBET): A web3 gaming company building its treasury for future staking.

- Coinbase Global, Inc. (COIN): Holds ETH as part of its operational and investment reserves.

- See the complete up-to-date list here.

Ethereum Treasuries vs. Bitcoin Treasuries

While both Bitcoin and Ethereum are widely adopted digital assets, there are important differences between treasuries holding ETH versus BTC:

- Utility: ETH is not just a store of value but also fuels applications, staking, and DeFi protocols.

- Yield: Ethereum treasuries can earn yield through staking, whereas Bitcoin treasuries typically do not.

- Smart Contracts: Companies may need ETH to interact with smart contracts or build on-chain products.

- Market Dynamics: Ethereum’s price dynamics and volatility can differ from Bitcoin, impacting treasury management strategies.

Risks & Considerations

- Volatility: ETH prices can fluctuate rapidly, impacting company balance sheets.

- Regulatory environment: Changes in regulations can affect how companies report and use ETH holdings.

- Technical risk: Secure storage, wallet management, and private key security are crucial.

Further Resources

- See our Ethereum Treasuries main table for the live list.

- Bitcoin Treasuries (comparison)

- Official Ethereum website